Trading introduces risk, as simple as that. Successful trading depends more often than not on proper risk management. Mercurius recognized that risk management should be an integral part of trading and therefore we incorporated sophisticated risk management tools in our trading platform.

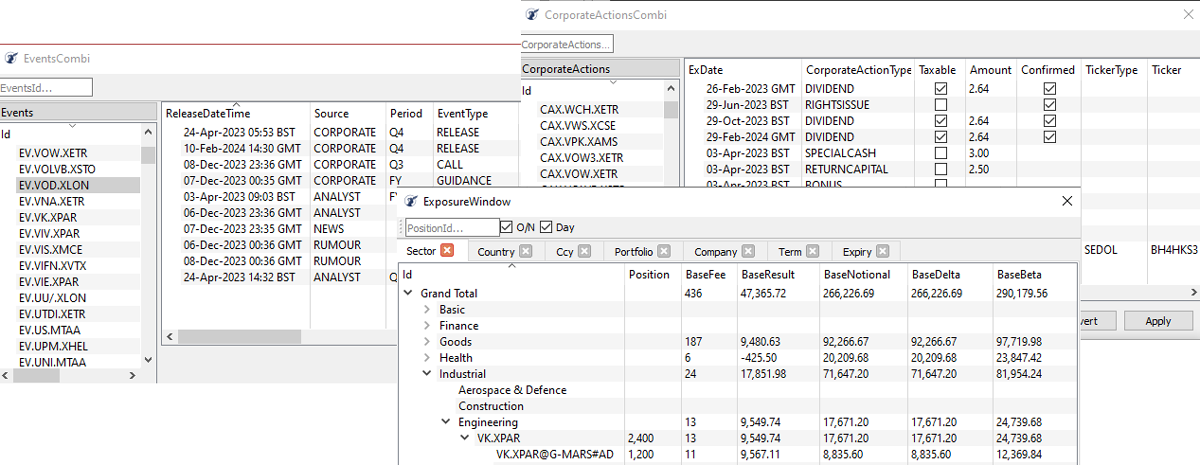

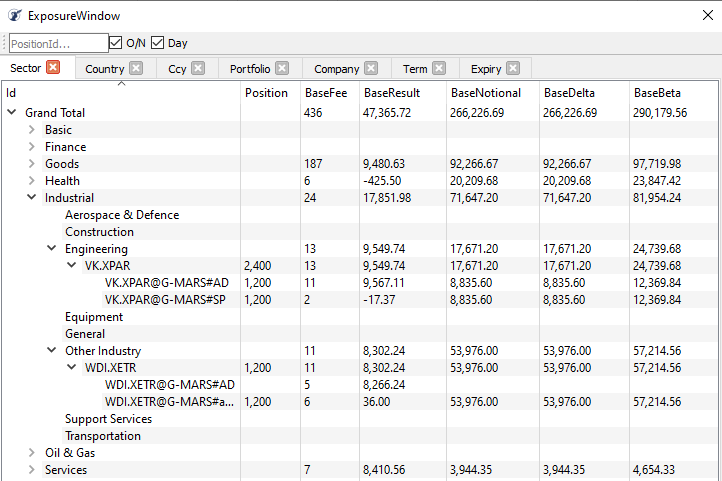

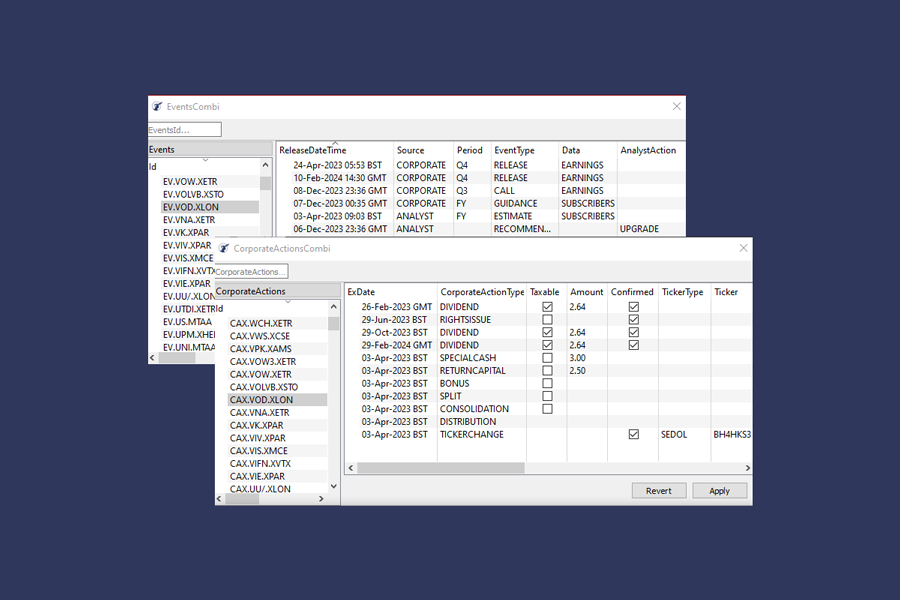

Mercurius offers you the tools to remain compliant with applicable regulations like MiFID and country specific short-selling regulation as may be applicable from time to time. Tools to keep exposure within internally set risk parameters are versatile and flexible. Limits can be set not only an individual orders and portfolios, but also to control order flow to specific destinations in term of orders sent per unit of time. Limits can be specific to asset classes, geographical regions, counterparty et cetera. The sky is the limit.

An extensive user privileging system completes the risk management tools, setting constraints on what users are allowed, with pre-defined admin and risk roles. Users may or may not interfere with orders and algo's, can be subject to a personal set of limits or not. Versatility is key.